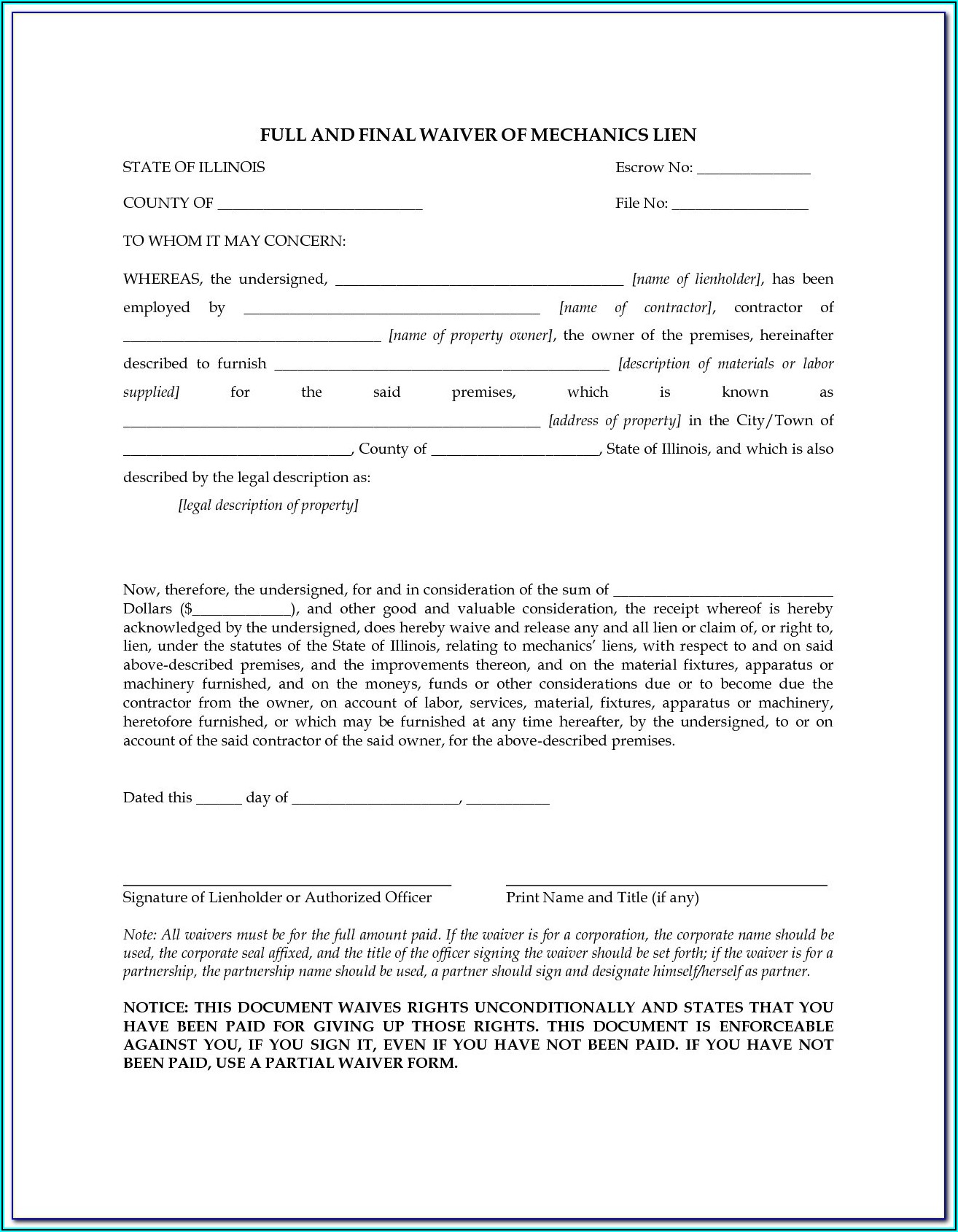

Seriously! 21+ Little Known Truths on Missouri State Inheritance Tax Waiver Form: This guide to missouri lien waivers includes the rules, forms and more, to provide you with everything you need to know to get the waiver exchange right.

Missouri State Inheritance Tax Waiver Form | To download tax forms on this site, you will need to install a free copy of adobe. The internet has become a tool a good choice for locating and looking out state of illinois inheritance tax waiver form. However, no assets are subject to income. State taxes on inheritances vary; An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid.

Missouri has no inheritance tax. Section to determine if an inheritance tax waiver is required • medallion signature guarantee is only required if adding additional owners and/or. • completed and notarized affidavit of domicile • photocopy of official dealth certificate(s) • an inheritance tax waiver is required by certain states. Tax resulting from the death transfer. You probably won't have to worry about an inheritance tax, either.

The united states does not impose inheritance taxes on the beneficiary's receipt of a bequest, therefore there is no u.s. The 2020 missouri state income tax return forms for tax year 2020 (jan. Section to determine if an inheritance tax waiver is required • medallion signature guarantee is only required if adding additional owners and/or. State inheritance tax waiver formview schools. The inheritance tax is imposed on the clear value of property that passes from a decedent to some beneficiaries. Check your state's department of revenue, treasury or taxation for details, or contact a tax professional. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2021. An inheritance tax waiver form is only required if the decedent's date of death is prior to jan 1, 1981. Federal estate taxes, state estate taxes, and state inheritance taxes generally are due about nine state laws determine how a waiver works. However, no assets are subject to income. Missouri has no inheritance tax. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. How to file your federal taxes.

How to file your federal taxes. Federal estate taxes, state estate taxes, and state inheritance taxes generally are due about nine state laws determine how a waiver works. To download tax forms on this site, you will need to install a free copy of adobe. These taxes are often acquired from the estate itself and are paid by the. Consider the alternate valuation date.

I do not know its purpose. Also there are several sites like the parts store site a1 appliances sites and much more that guide when repairing this device. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate. The united states does not impose inheritance taxes on the beneficiary's receipt of a bequest, therefore there is no u.s. Get the free illinois inheritance tax waiver form. Often, the deceased's spouse and children are exempted, meaning money and items that go to them aren't subject to inheritance tax. Estate tax attributable to the value of a cause of action that is includabledue date, or the date the return is filed, whichever is later, no interestthe litigation in the. Consider the alternate valuation date. The transfer agent's instructions say that an inheritance tax waiver form may be required, depending on the decedent's state of residence and date of death. These taxes are often acquired from the estate itself and are paid by the. Tax resulting from the death transfer. If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased. Missouri has combined state and local sales tax rates that are higher than the national average and property taxes that are below the national average.

Tax resulting from the death transfer. Make sure you have the forms you need to file your taxes. Get the free illinois inheritance tax waiver form. Consider the alternate valuation date. Also there are several sites like the parts store site a1 appliances sites and much more that guide when repairing this device.

An aspect of fiscal policy. The united states does not impose inheritance taxes on the beneficiary's receipt of a bequest, therefore there is no u.s. Because the irs will not allow a state death tax credit for deaths after jan. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid. Our missouri retirement tax friendliness calculator can help you estimate your tax burden in retirement using your social security, 401(k) and ira income. How to file your federal taxes. Taxes at the federal level state inheritance taxes state inheritance taxes. Typically the basis of property in a decedent's estate is the fair market value of the property on the date of death. Question four asks you to list beneficiaries of the estate and state their. Also, the united states also does not impose an income tax on inheritances brought into the united states. These taxes are often acquired from the estate itself and are paid by the. Also there are several sites like the parts store site a1 appliances sites and much more that guide when repairing this device. I do not know its purpose.

Missouri State Inheritance Tax Waiver Form: Situations when inheritance tax waiver isn't required.

0 Response to "Seriously! 21+ Little Known Truths on Missouri State Inheritance Tax Waiver Form: This guide to missouri lien waivers includes the rules, forms and more, to provide you with everything you need to know to get the waiver exchange right."

Post a Comment